In the first 25 years of our company’s history, dating back to 1993, 100 percent of our transitions were from one solo practitioner or partnership to another. For some buyers, this might have been their second, third, or even fourth office – but they were all dentists who would have direct involvement in the practice they were buying.

The final act of each closing was to take a picture of the selling doctor handing the keys to the buyer, smiling faces all around as one dentist passed his or her legacy on to the next buyer.

The last several years indicate these types of closings will be less and less common as DSOs – dental service organizations – become a larger segment of the buyer pool. DSO penetration here in the Central Plains has lagged other parts of the country such as Texas, Florida, Colorado, and the Northeast, but it’s safe to say private equity-backed dental groups are here — and they aren’t going anywhere.

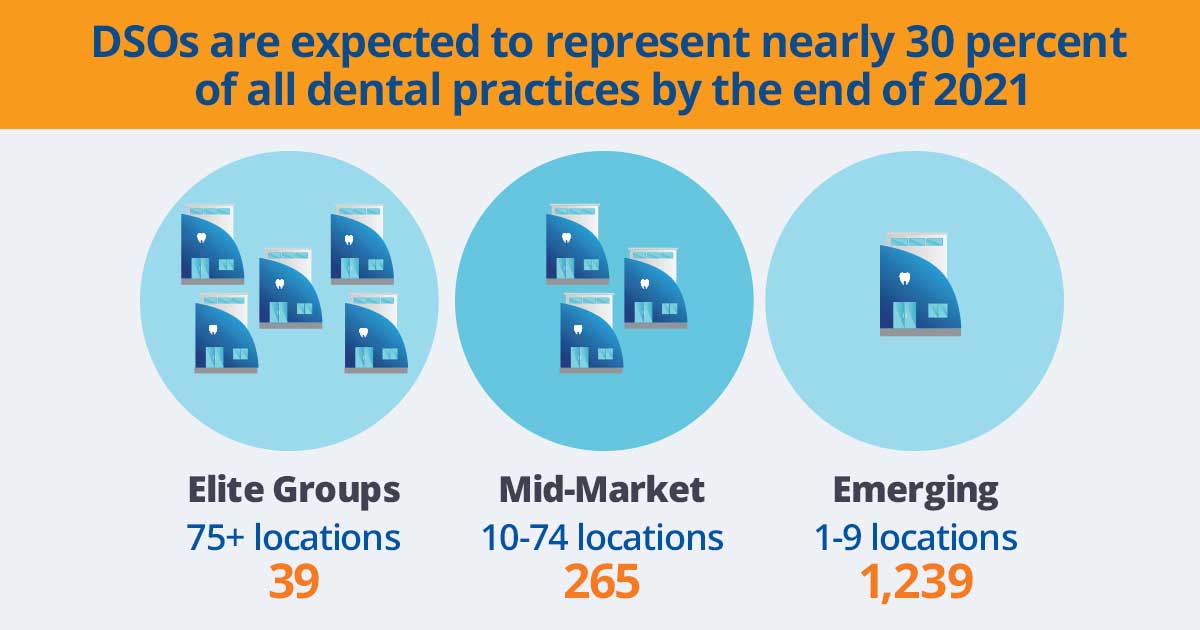

According to a recent presentation by Aligned Dental Partners, DSOs are expected to represent nearly 30 percent of all dental practices by the end of 2021, with the following breakdown by size:

A DSO (Dental Service Organization) is a structured organization that helps manage administrative tasks for dental practices such as billing, support, training, and more. The dental The DSO model goes back several decades, but it wasn’t until the mid- to late-1990s that pioneers such as Heartland and Aspen began to emerge at scale. It is the recent rapid expansion of the Emerging and Mid-Market groups that are now making the biggest waves and presenting more intriguing options to potential sellers. While most of these groups would still prefer for the seller to continue working, many of them are associate-driven or have local equity partners that may make it possible for the doctor to sell and not have to continue working for three to five years.

Most dentists over the age of 55 are bombarded with daily direct mail and other solicitations about how they can sell their practice to these organizations. Given the wide range of DSOs and their unique cultures, practice philosophies, support services, reputations, and financial outlooks, it is important for dentists to conduct their own due diligence as they start to go down the path of selling to a DSO.

Here are six important questions to ask if considering selling to a DSO.

In today’s rapidly changing market, dentists have numerous options to sell their practices, yet most do not know where to start or what is involved. ADS transition specialists are uniquely positioned to leverage their experience in the marketplace to help sellers explore these various options to achieve the things they want most: legacy preservation, competitive pricing, staff protection and the right dentist or group to take over the practice. Whether that is selling to a DSO or finding a more traditional owner operator, your local ADS consultant can guide you through the process.

Tom Wolff has been the owner and primary broker of ADS MidAmerica since 2019. Following in the footsteps of the company founder, Evan Myers, and his dad, Dr. Steve Wolff, Tom has remained true to the company’s core philosophies around dental transitions while continually finding new ways to adapt to the modern dental market. ADS MidAmerica has been serving dentists across Missouri, Kansas, Nebraska and Iowa since 1993. Specializing in practice valuations and transitions, the company has handled the sale of more than 300 practice sales across our market.